General Ledger Software

General ledger refers to each transaction posted to the chart of account. Let’s start from the beginning, when you choose an accounting software it requires some setup. Part of that setup is creating a chart of account. In Simply Accounting software program, chart of account represents a series of 4 digit numbers. the first number represents the category, the last 3 numbers represent the account description.

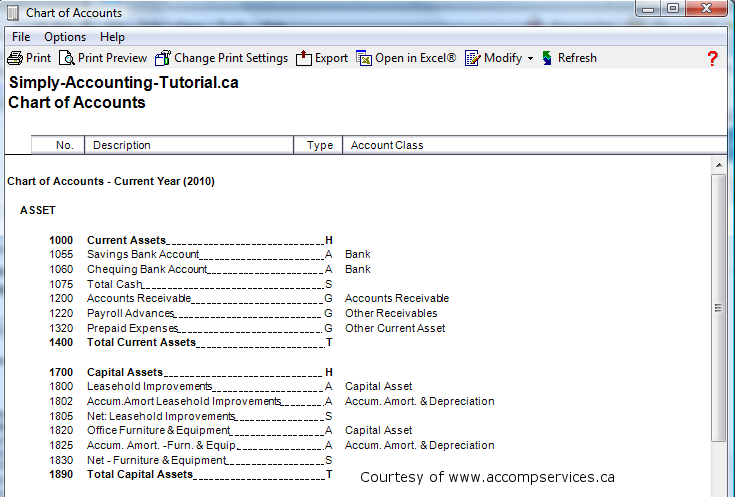

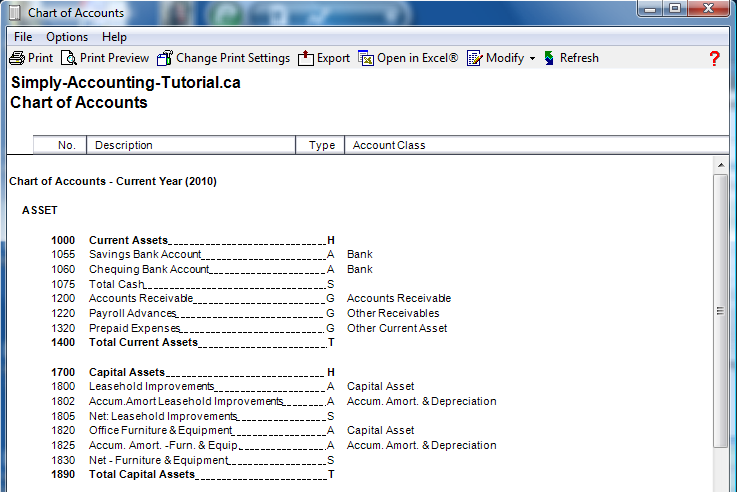

To view a chart of accounts click on Reports – Lists – Chart of Accounts. Below is the 1000 – 1999 series that represent the current and long term assets.

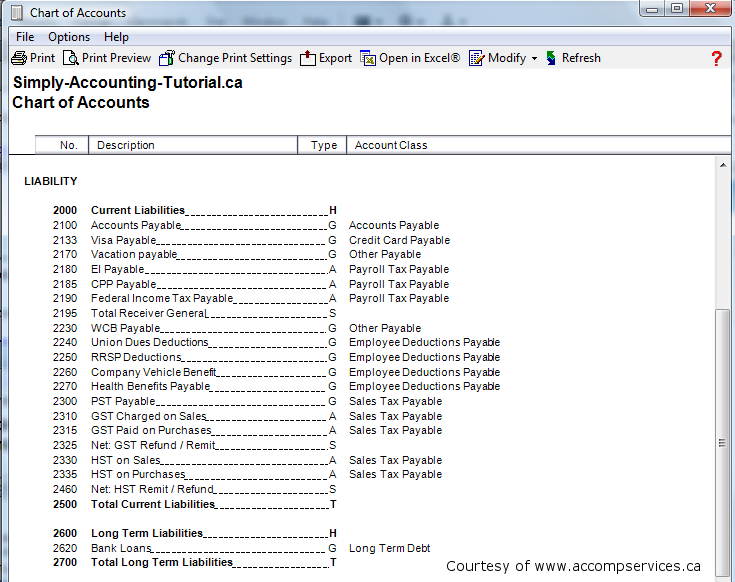

The 2000 to 2999 represents current and long term liabilities. This section shows the company’s liability.

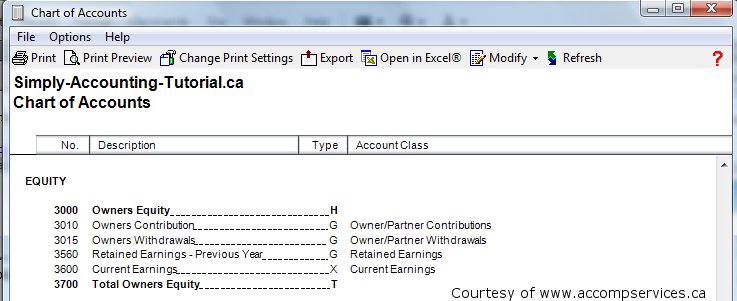

The 3000 to 3999 represents equity for capital. This section shows the current earnings and previous years accumulative earnings. It also shows the owners contribution into the business.

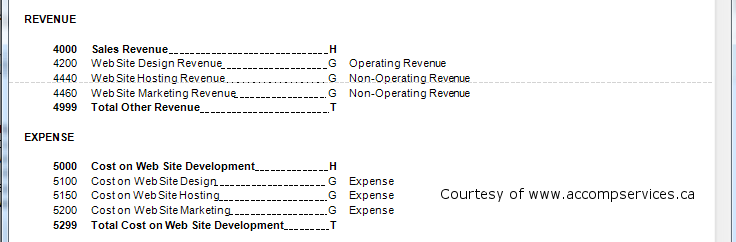

The 4000 to 4999 account series represent sales. Most companies would like to compare sales with their costs, so it is beneficial to set up your sales categories to match your cost of goods sold.

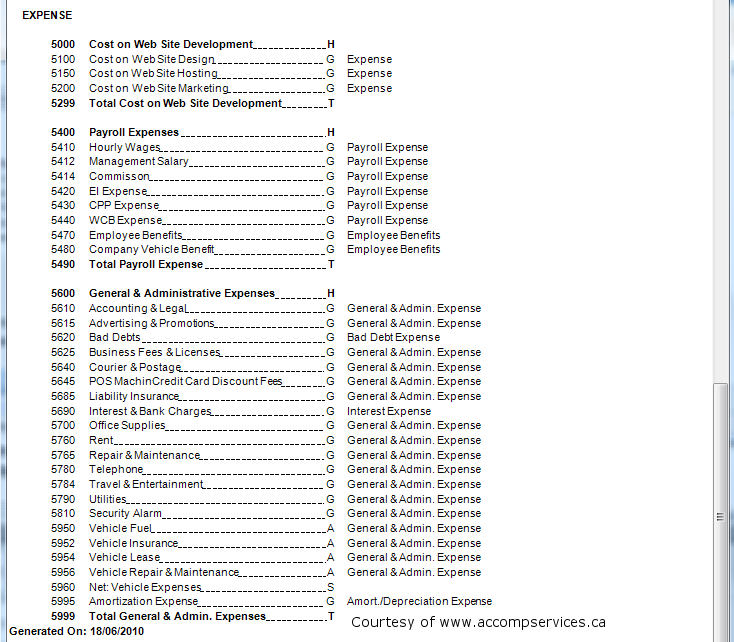

The 5000 to 5999 are the different categories of business expenses.

1st category (5000 – 5299) is the cost on web site development

2nd category (5400 – 5490) is the wages and salaries

3rd category (5600 to 5999) is the administrative expenses

Notice the vehicle expenses are grouped together for better display of costs on vehicle.

Lets do some data entry. There are 3 main methods used to record an entry.

1-Purchase journal

2-Sales journal

3-General journal

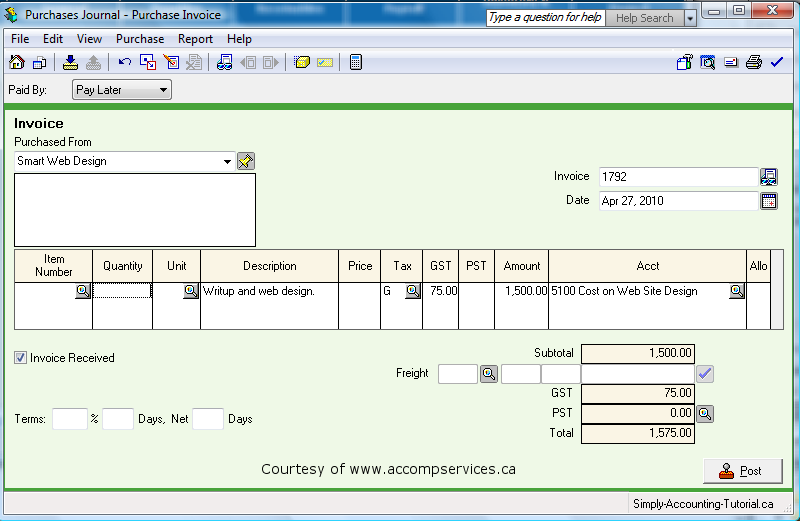

Purchase journal – used to record supplier invoices, inventory purchase for resale, and expenses such as utilities, meals or office supplies. In Simply Accounting program you can view the transaction and see which account in the chart of accounts is being affected prior to posting. See below for a purchase invoice.

This is a 30 day account, meaning this invoice is due in 30 days (May27,2010) Therefore the paid by is set as pay later. the supplier is picked to be Smart Web Design. Invoice number is 1792 and the date of the invoice is Apr27,2010.

This is a service invoice, therefore the “Item Number”, “Quantity” and “Unit” do not apply. It is a good idea to give a description of what the invoice is for, the tax code is “G” for 5% GST the amount is the total amount on the invoice including all taxes. The total on this invoice is $1,575.00.

Now lets look at how this invoice will be posted and what accounts in the chart of accounts will be affected.

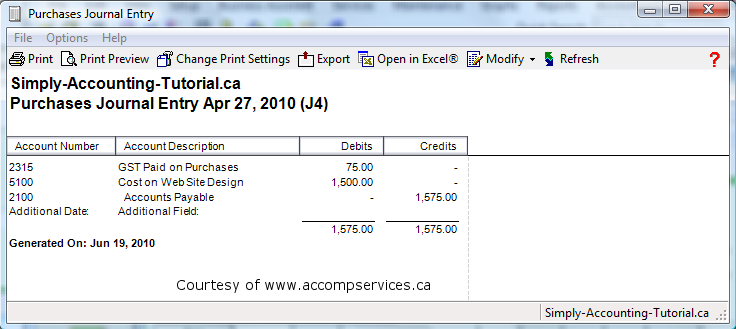

At the top, on the menu bar click on Report – Display Purchases Journal Entry. This is what you should be looking at:

Government liability has increased by $75.00 and accounts payable liability to Smart Web design by $1,575.00. The expense category has increased by $1,500.00. The journal entry number for this transaction is (J4).

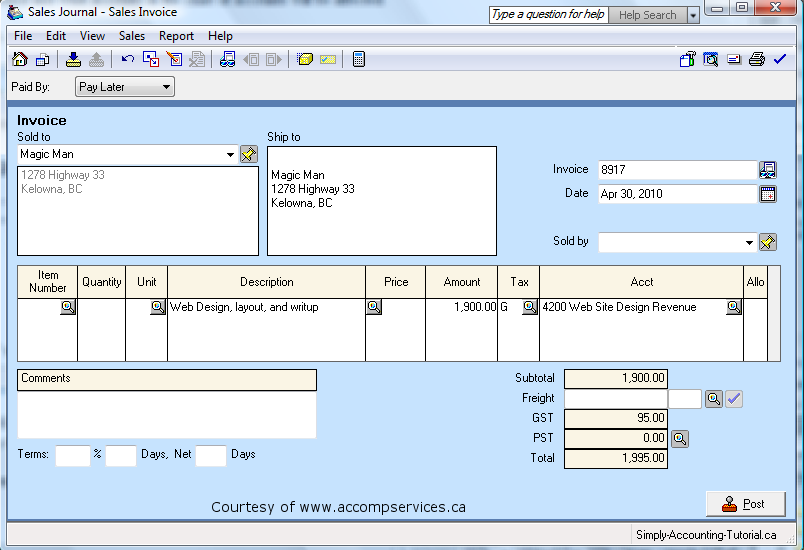

Sales journal – is the opposite of purchase journal. Here you sell your product or services. Lets invoice Magic Man for the cost of the web design.

Magic Man has a 30 day account, therefore it is set as pay later. The invoice number is generated by Simply Accounting program automatically. The date is the day of the invoice, The description is indicated as web design and write up, the amount in net of taxes, and the account number is the designated sales account. The total owed by this customer is $1,1995.00. See below the journal entry.

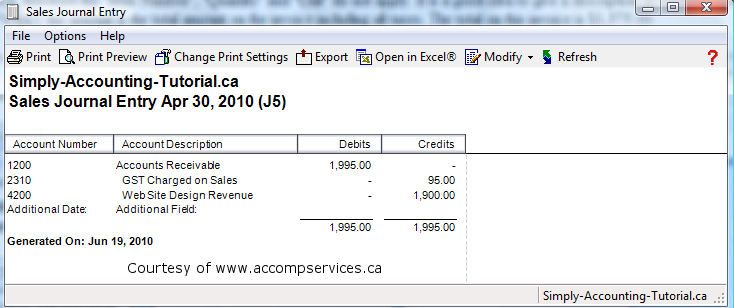

Click on Report – Display Sales Journal Entry to see what accounts in the chart of accounts will be affected prior to posting

The asset Accounts Receivable is increased, The liability for GST on Sales is $95.00 and your Web Site Design Revenue account is increased by $1,900.00. The journal entry number for this transaction is (J5).

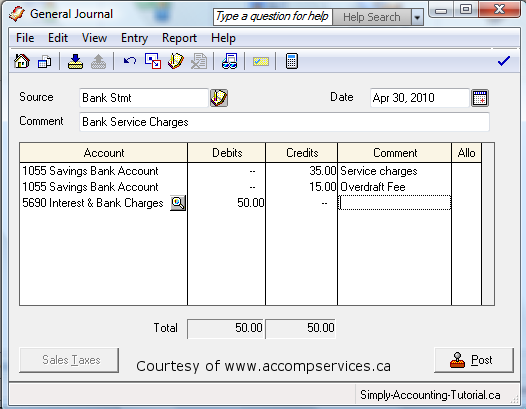

General journal – is used mostly in my accounting office for all non taxable entries like,: bank service chares, loan repayments, owner withdrawal and or contributions. Lets look at an entry, on your home screen click on General Journal.

Notice the bank account has been chosen twice, this is because it shows on your bank statement as two separate entries so I post it the same as bank. I have indicated in the comment section what each service charge relates to. It is a good idea to get into a habit of using the comment or description sections of this program.

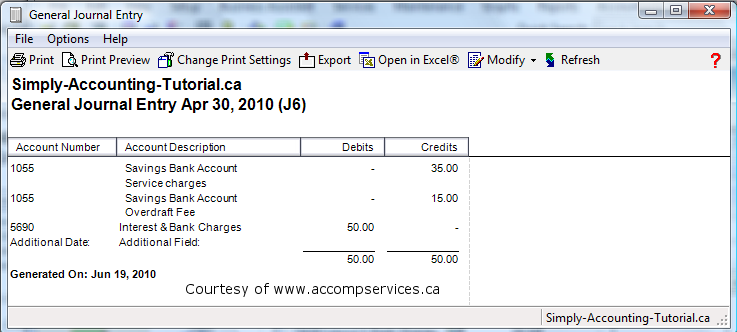

Now, click on Reports and Display General Journal Entry to see what accounts in the chart of accounts will be affected.

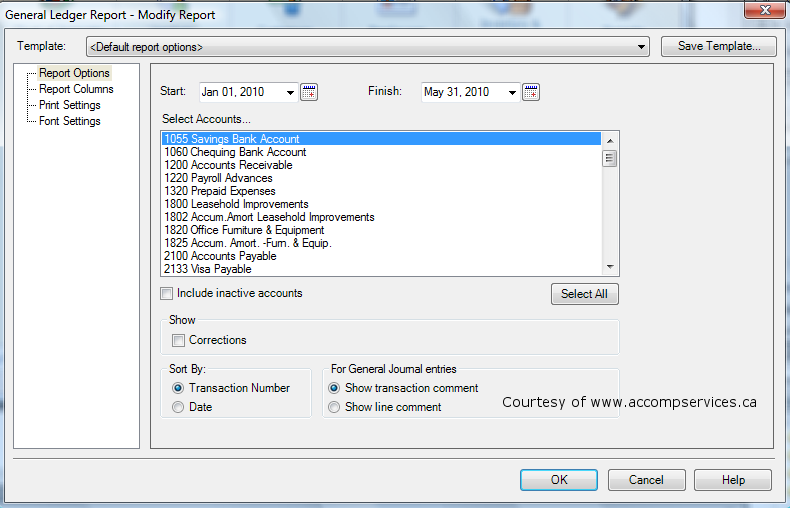

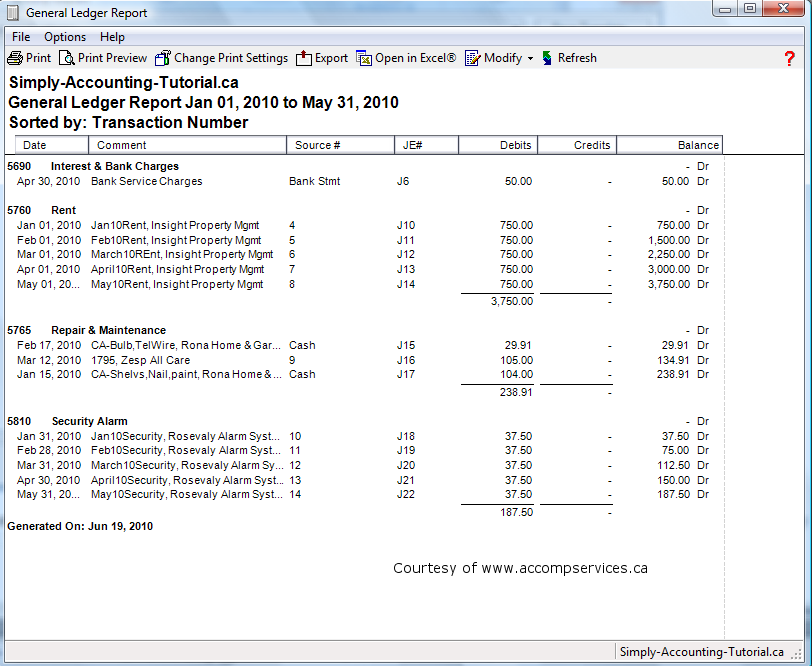

I will now show you how to bring up a general ledger report where you will see J4, 5 and 6.

On your home screen click on Reports – Financials – General Ledger. You should be looking at this screen:

You can specify the star and finish date. Choose to see just on account or more by highlighting in blue the ones you want to capture on this report, or simply click on “Select All”. You have a choice to sort your report by transaction number or by date.

This report shows each account with detail entries separately with total of each account. This is where all entries get recorded and financial statements are generated from these entries.

I will leave you with a quote by John D Rockefeller Jr. “The secret of success is to do the common thing uncommonly well”

Hope this tutorial will help you in your business. If you have specific questions I will be happy to answer them for you. Just drop me a note at http://www.accompservices.ca/blog

Follow me at twitter:

Accounting Chart

The chart of accounts are listed as:

Balance Sheet = assets, liabilities and owners equity

Income statement = revenue, cost of goods sold, wage and administrative expenses.

In this tutorial we are going to use Simply Accounting software program version 2009, and will learn how to create a chart of accounts from scratch. Open your Simply Accounting software to home screen. Home screen is shown below.

Next, click on Chart of Accounts. Your screen should look like this:

You should see a yellow screen with heading. This screen will fill up as you creat accounts in different categories.

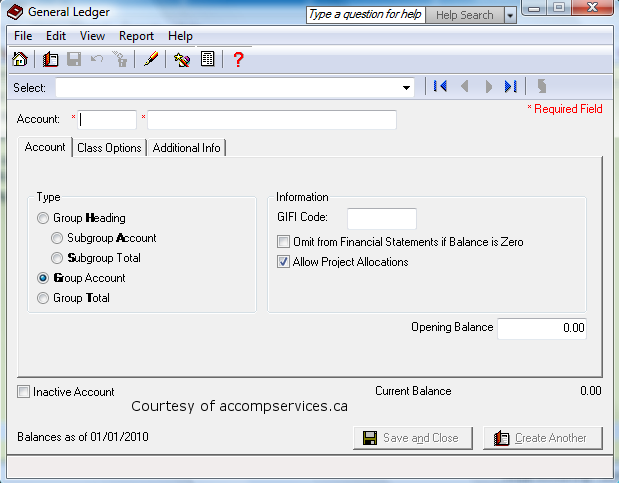

So, lets begin. click on file – create. your screen should look like this:

The chart of account represents the following categories.

1000 to 1999 is set for current and long term assets

2000 to 2999 is set for current and long term liabilities

3000 to 3999 is set for owners contribution, current and retained earnings

4000 to 4999 is set for Revenue

5000 to 5999 is set for cost of goods sold, wages, and administrative expenses.

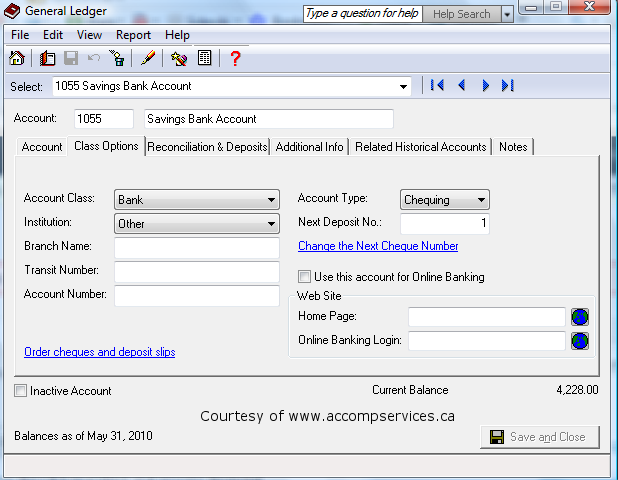

lets creat a few accounts. From the top choose the account number, I have 1055 and my description for that account is Savings Bank Account.

The type is a subgroup account and on the chart of account report it is represented with a letter “G”

Under information GIFI stands for General Index Of Financial Information created by the Canada Revenue Agency in 1999, the GIFI is a system which assigns a unique code to a list of items commonly found on income statements, balance sheets, and statements of retained earnings.

The purpose of the GIFI is to allow the CRA to collect and process financial information more efficiently; for instance, the GIFI lets the CRA validate tax information electronically rather than manually.

For the purpose of setting up the chart of account I will allow Simply Accounting to designate the GIFI Codes.

Click in the box and you can choose to omit this account from financial statements if the balance is zero.

Click in the box if you are using project allocation.

Click on the next tab “Class Options“, your screen should look like this:

It is important to give your accounts a Class Option. The class option for this account is Bank. If you drop down the menu you will see a list to choose from.

Now that you know how to create your chart of accounts, I have a sample one for you to look at and you can adopt the accounts for your business and add more if needed.

Here is a sample of a chart of accounts. Click on the image for a full view.

I hope this tutorial has helped. Drop me a note at http://www.accompservices.ca/blog for any questions.