what is the best way to close off year end and advance to new year.

Our fiscal year end is June 30 and we want to advance and start entering data in the new year, July 1.

I tell a lot of people its very easy to set the session date July 1 and your ready to go. but take a moment and make a archive copy of the June 30 year end.

This is how you do it, drop down the File menu in the home screen and choose Save As.

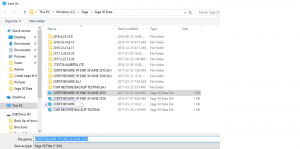

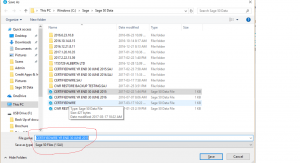

This is how my Save As screen looks like. As you can see prior years are saved as well.

Take a note, for every folder .SAJ there is a corresponding data folder with .SAI.

Make sure that you have both the yellow folder and the data. In sage 50 one will not work without the other. If you want to open any of these archive files you must have both .SAJ and .SAI.

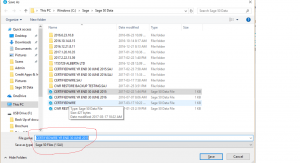

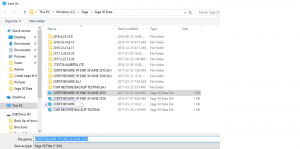

Now you can give it a file name and save.

Once you save the archive copy you should not do any new entries in it.

This Archive copy is not linked in any way with your current file that you work with.

If you need to do any entries pertaining to previous year, stay in your current set of data and back date the entry.

This Archive copy should only be used for viewing.

Once you have saved the Archive copy Close down Sage 50 and re-open and choose your current file.

Mine is always the one with no Data just the company name.

select the data file and when Sage opens to the session date, enter July 1, 2017. The system will close off the Income Statement and transfer earnings to the Balance Sheet and your ready to input data into the new business year.

Hope this was helpful.

If you have specific questions don’t hesitate, just go to Ask Questions and drop me a note.

The Session date is important to Sage 50 as well as accounting and entering data.

The following are the different legal statuses a company can have.

Sole Proprietorship

Partnership

Incorporated

Non Profit

In the case of Sole Proprietorship and Partnership, the fiscal year end must be December 31. As per CRA.

Ex: if you started your business in March 2017 your fiscal year end must be December 31, 2017.

It will be a short year (9 months) but the following year will be 12 months.

in the case of Incorporation and Non Profit, you can have any fiscal year end you like but can not go over 365 days.

Ex 1: if the company start date is March 1, 2017, the fiscal year end can not go over February 29, 2018, must stay within the 365 days.

you also have the choice of having a December 31, 2017 year end but the first year of business will be a short year as well.

Ex 2: have a client who is operating as a Sole Proprietorship. He will bring me a big box of papers separated in month order. so I will have 12 folders (Jan – Dec 2017)

When I am ready to start on his account I will set the session date to December 31, 2017 and work within my range of Jan – Dec 2017. In this case it is not necessary to change the session date every day or very month. It is set for December 31, 2017 and I will work within the year. The system will let you know that I am entering in the previous months but I accept.

Ex 3: I have clients that are Non-Profit or Incorporated and when I am ready to enter their data I will look at the fiscal year end and weather they have payroll or not.

Lets say the fiscal year end is February 29, 2018 and they do have payroll. Their will be 12 folders in the box from March 1, 2017 to February 29, 2018.

I will set the session date for December 2017. I do this due to payroll. If the customer has paid wages I need the session date to remain as December 31, 2017 for if I advance in to January 1, 2018 all the tax calculations will be off for 2017 payroll.

Once I am satisfied that the payroll is correct, all Source Deductions have been remitted and the T4 and T4 Summary are complete, I will than advance in to January 2018.

I guess the only thing to keep in mind is that if you are a Non-Profit or Incorporated and have payroll, do not advance beyond December 31.

Hope this helped to lesson the confusion about session date.

Let me know if you have a specific question.