Source Deduction Calculation & Remittance

There are two ways of figuring out balance owing to CRA for Source Deductions.

In this tutorial I will show you how to look up, record and pay this amount to CRA.

First you need to know how much to pay.

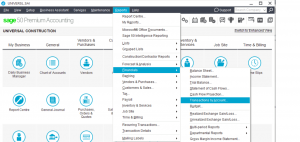

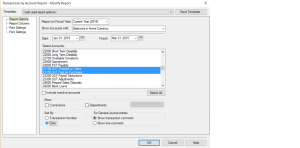

Go to Reports, Financials, Transactions by Account or General Ledger (depending on the version of Sage 50 you have).

See Below.

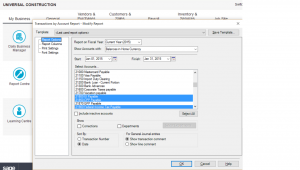

Choose the date that you need to remit source deductions for. Mine is January 1 – 31, 2015. and the balance is due by February 15, 2015.

I have highlighted the 3 accounts I need and the report will sort by Date.

click ok.

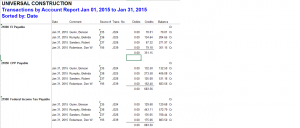

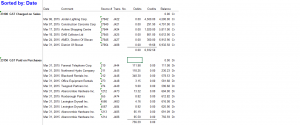

I exported my report to Excel just so I can shrink it for this tutorial.

Yours will look a bit different being printed directly out of Sage 50 program.

Now we know how much to pay. these amounts include both employee and employer portion.

No other calculation is required.

EI is $351.15

CPP is $683.56

Tax is $883.50

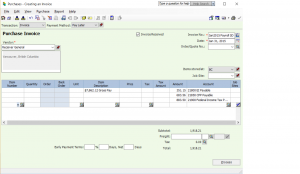

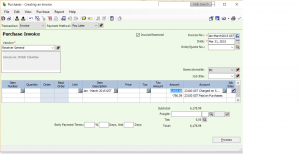

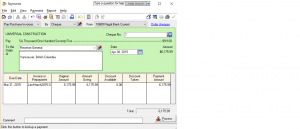

Open purchases journal and pull up Receiver General or what ever Vendor name you have for CRA.

From the top:

Transaction = Invoice

Payment Method = Pay Later

Invoice no = I have my own invoice # (Jan2015 Payroll SD) SD is for Source Deductions. you can adopt any system you like.

Date = the pay period ending date which for me is Jan 31, 2015.

and in the body of the invoice I have recorded the amounts owing and posted them to the appropriate liability account.

the balance to be paid is $1,918.21.

process

According to CRA this amount is due by February 15, 2015.

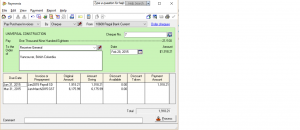

So on that date I will go to payments and generate a chq for this amount.

I can mail it to CRA or pay it at the bank.

Note: if you are mailing it to CRA generate the chq earlier to give time for mail.

And you are done.

You can follow the same steps for GST / HST.

Hope this tutorial helped.

If you have specific questions I be glad to help.

Send me a note in the questions area.