Hi Ellis

Your question is about the cash account.

Sorry for the previous email. I miss-understood.

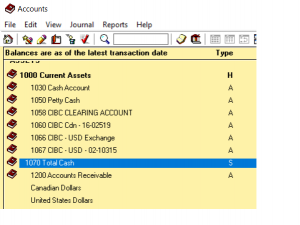

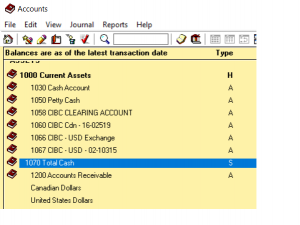

To try to answer your question properly. do you mean a cash Account in the chart of account. Like this.

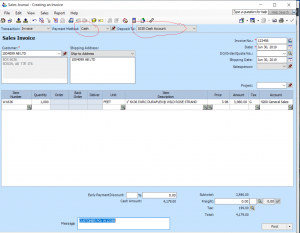

and here is an entry that is affecting the cash account.

Ok, if this is what is happening? A transaction bas been posted to cash Account.

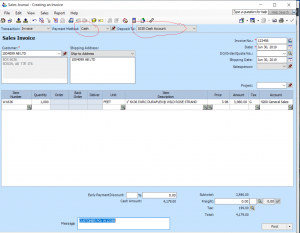

Credit Sales and Debit Cash Account.

Question is: did the money received from the customer be deposited into the actual company bank account? if it did.

Than the entry you need to make is:

Credit Cash Account and Debit Bank Account.

if the cash received by the customer did not end up as a deposit into the bank account. than you need to find out what happened to it.

Maybe the cash was used to purchase shop supplies or office supplies. you need to investigate what happened to the cash and make appropriate entry.

Credit Cash Account and Debit supplies or office or…. another expense account.

Hope this helped

nk

Categories:

09- Receipts Tags:

Hi everyone.

Recently I was asked how to set up tax table with split taxes.

ex: 5% GST (2.5% and 2.5%)

if you have man suppliers or customers with this type to of tax splitting you can set it up in the tax section.

if not I will show you how to enter it at the time of posting the invoice.

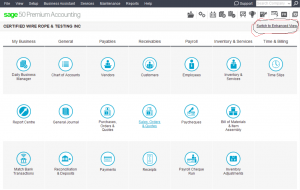

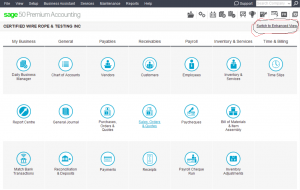

This tutorial will be in the classic mode as shown below.

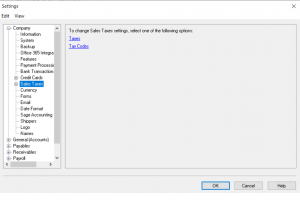

From the top menu choose Setup – Settings – Company – Sales Taxes.

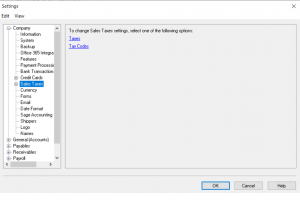

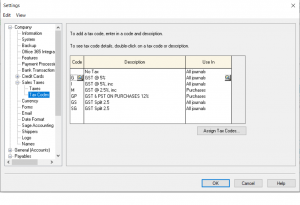

This is where you should be.

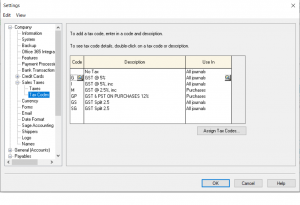

From here chose Tax Codes below.

in this screen you will record all the tax code you have followed by a description.

you can also choose to see the tax code in a specified journal. either payable or receivable.

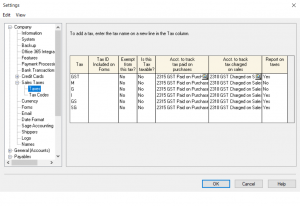

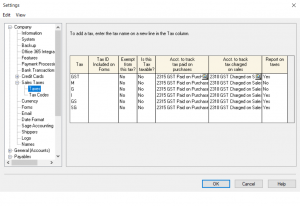

No click on Taxes below.

here you will issue the codes a relative account number. one for payables and one for receivables.

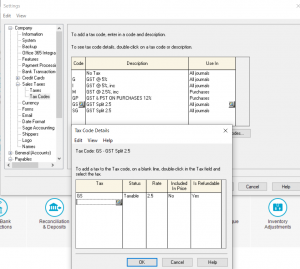

Now that we are familiar with the Taxes and Taxes Code screen.

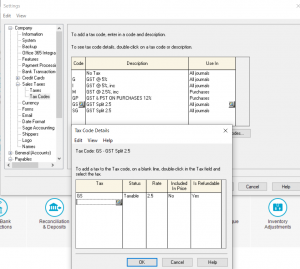

lets go back to Taxes Code screen and choose the GS Tax Split in order to give it a percentage for calculate.

Do the same for the SG code and press OK.

Do the same for the SG code and press OK.

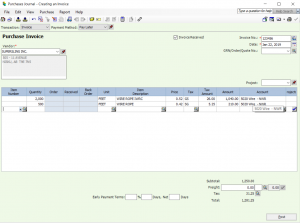

Now lets test the taxes created.

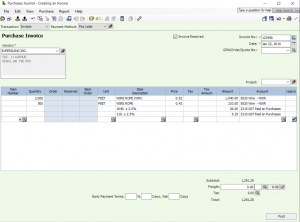

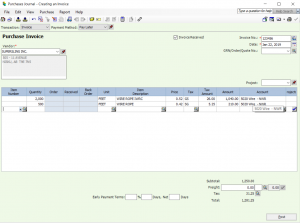

Go to purchase journal, choose a vendor and test the tax codes.

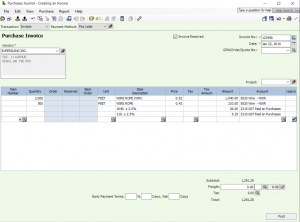

Now lets look at an entry with the tax codes not set up.

Hope this tutorial helped.

if you have other questions please drop me a note.

nk