GST Tax Table Setup

How to set up tax table in Sage 50

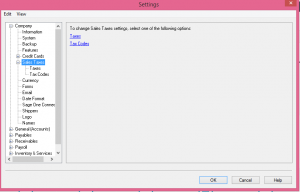

from home screen drop down Setup menu – Settings – Company – Sales Taxes.

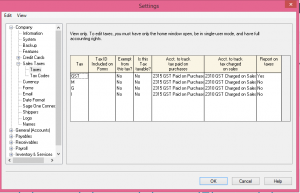

First, lets click on taxes.

In the Tax colum you can give unique tax names.

In the Tax colum you can give unique tax names.

Ex: GST, HST, PST depending on the province.

indicate the account number that will be tracking this tax.

For payables account description “GST on Purchases”

and receivables account description ” GST on Sales”

These two accounts should already be setup in the chart of accounts in the liability section.

Ex:

account 2410 Description “GST on Purchases” ( for type choose the subgroup account)

account 2420 Description “GST on Sales” (for type choose the subgroup account again)

Account 2430 Description “Net GST Remit / Refund” (for type choose subgroup total)

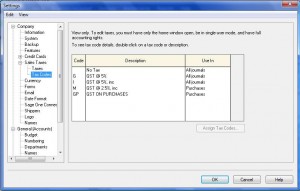

now, lets click on Tax Code

The code section is designated for your taxable goods.

The code section is designated for your taxable goods.

ex: GS and in the description section type: GST on Sales

GP and in the description section type: GST on Purchases

GV – and in the description section type: GST on Vehicle – if you are a company that uses a percentage of the vehicle for business and rest for personal than you have to take a percentage of GST as well. do not claim the full amount of GST when the vehicle is being used fa portion of time.

GM – and in the description section type: GST on Meals – The meals are expenses at 50% so the GST has been claimed at 50%.

in the USE In Colum – indicate if its for Vendor purchases or sales receivable.

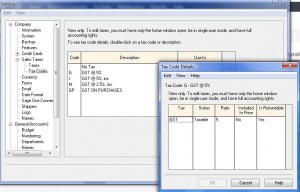

Now lets click on the first code “G”

In the tax colum you will put GST or PST, the name of the tax.

In the tax colum you will put GST or PST, the name of the tax.

Status is Taxable

Rate is 5% or other rate depending on the province

Included in price will be “yes” if its for tracking vendor taxes

it will be “No” if its for tracking sales tax

Is refundable will be “Yes” for GST and will be “No” for PST

Hope this helped with setting up tax tables.

Please send me note if you need further explanation.

Can you explain the “Status is Taxable”, The rate is 5%. This actually changes the hst amount and I have to enter the correct amount manually

Hi Gina

The tax tables can be confusing.

I did up a tutorial for you and hope it will help.

I am not sure if your tax tables are set up but here you can follow the instructions.

Let me know if it worked or you have any other questions.

http://www.simply-accounting-tutorial.ca/accounts-payable-tutorial/gst-tax-table-setup