GST/HST/PST Setup Tutorial

This tutorial will look at how to setup tax tables on Sage 50 Simply Accounting. Depending on where you do business your GST/HST/PST set up will be different.

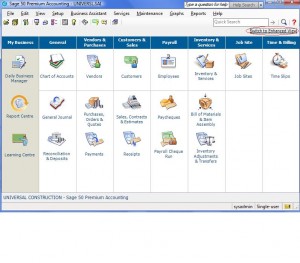

Below is the home page of Sage 50 Simply Accounting Classic View.

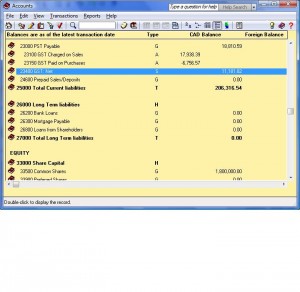

Step 1 – Create the necessary accounts in the chart of accounts. On home page click on Chart of Accounts. I have PST / GST accounts setup to track taxes. If you live in a province that collects HST create HST paid on purchases and HST charged on Sales. You do not need a PST account.

Step 1 – Create the necessary accounts in the chart of accounts. On home page click on Chart of Accounts. I have PST / GST accounts setup to track taxes. If you live in a province that collects HST create HST paid on purchases and HST charged on Sales. You do not need a PST account.

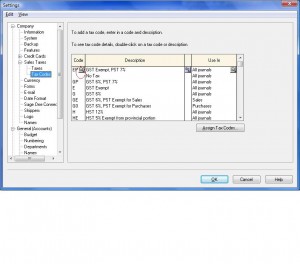

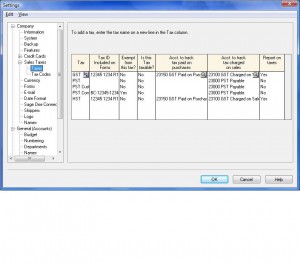

Step 2 – Now that we have our accounts created, lets create our tax table and link these accounts. From the setup menu click on Settings – Company – Sales Taxes and Taxes.

Step 2 – Now that we have our accounts created, lets create our tax table and link these accounts. From the setup menu click on Settings – Company – Sales Taxes and Taxes.

There are several colums in the setting stage. the first is the Tax Colum. Type you tax name used in your province.

Tax ID Included on Forms – type in the tax number issued to you by the government.

Exempt From this Tax? -Type No or Yes. they should all be No but in case of PST you could be exempt.

Is This Tax Taxable – Type No. There is no extra tax on top of this tax.

Acct. to track tax paid on purchases – this is where you would link the accounts you created to track taxes.

Do the same for tax charged on sales.

Reports on Taxes – You can allow Sage 50 Simply Accounting to give you a report on GST/HST to show how much taxes have to be paid to Revenue Canada or refund. I normally calculate it myself by printing reports. Watch GST Payable setup. http://www.simply-accounting-tutorial.ca/general-ledger/sage50-simply-accounting-record-gst-payable

Now that you have completed the initial set up lets go to tax codes.

There on three colums. under Code you can type in a 3 character code to represent the tax being charged. Give it a description and choose what journal it will be used for.

There on three colums. under Code you can type in a 3 character code to represent the tax being charged. Give it a description and choose what journal it will be used for.

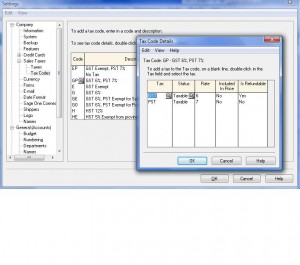

Now lets go deeper and issue a tax percentage to the coded.

This tax is GST and PST charged on Sales. click on magnifying glass and choose GST. Status is Taxable. Rate is 6% (in this case) Included in Price is No (on the sales invoice the tax should show up on a separate line) Yes for Is refundable.

This tax is GST and PST charged on Sales. click on magnifying glass and choose GST. Status is Taxable. Rate is 6% (in this case) Included in Price is No (on the sales invoice the tax should show up on a separate line) Yes for Is refundable.

on second line choose PST. Status is Taxable. Rate is 7%. Included is price should be No (it will have to show up separately on your sales invoice). is refundable should be No (PST is not like GST and a refund will not be allowed for this tax. Once ou set up all your taxes. click Ok.

This concludes our tutorial. Let me know if you have specific questions. Click on the link ask question or leave comment.

Scroll all the way down the page.

Hi. This is Angela Bosnich writing you. When paying for or receiving an amount due, what occurs with the GST and PST (payables and recoverables)? (Cash, Sales Discounts, A/R, GST, PST? A/P, PRA, Cash, GST?) Thank you for your time today.

Hi Angela

I think what you are asking is the entries done in AR or AP and where the GST or PST is posted as a result of the entry.

EX:

if you have a sale:

Generaly the entry goes like this:

Company X, purchased from you 105.00 worth of goods.

the Bank account is Debited or the AR account is Debited if the customer is paying in 30 days by $100.

the GST Account is Credited by the $5.00

and the Sales account is also credited by $100.

The net result is the 2 credits will equal the debit.

Ex. Now if you purchased an item for the company in the amount of $105.

Bank is being Credited for $105. or if your company has an account with this supplier than AP gets Credited by $105.

GST is debited by $5.00

and Expense account is debited by $100.

Once again the 2 debits will equal the one credit.

If your company collects PST you have to have a separate account for PST. This is different from HST, which is a combination of PST and GST which is 12% in BC (5% GST and 7% PST). you need to only have HST on Sales and HST on Purchases (2 accounts) to track entries in AR and entries done in AP.

but if you collect PST as in a retail store than you have to have a separate PST account to track the PST collected and remit to Minister of Finance.

Ex:

if we look at the AR example for $112.00,

the bank account or AR account is debited for the $112.00

the HST on sales account is Credited by $12.00

and AR is Credited by $100.

and the reverse for AP entry.

Hope this helped.

Let me know if you have other questions.

OK so I did everything you said to do.

Set up a new HST account, went into taxes and tax code did all that.

But when I enter the invoice with the new HST account number it still goes into the original account I was using.

I need to be able to track another provinces HST.

Thank You

Hi Susanne

so glad you reached out. I created a tutorial for you. I hope it helps.

Sorry for the late reply. was helping our daughter with her kids but now back at my desk.

here is the link, copy and paste it int he URL.

http://www.simply-accounting-tutorial.ca/gst-hst-reports-remittance/gst-hst-setup-for-provinces

Till next time.

nk