How to Adjust or Void cheque Tutorial on Sage 50

Hi Everyone

This tutorial is about adjusting or cancelling a payment made to a supplier. In some cases, I have made a payment and need to adjust that payment and reprint new cheque or I need to cancel or void the cheque all together.

For this tutorial, my home screen is set to Classic View. If you need to change. on the top right hand corner of sage 50 home screen you can change from Enhanced View to Classic View.

Let us get started.

First, we need to find the payment. Go to your sage 50 home screen and click on Payments.

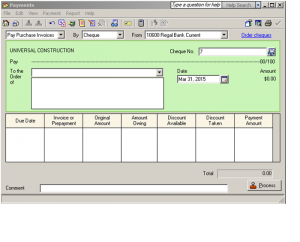

In the payment journal top menu bar drop down payment menu and choose Look up Payment.

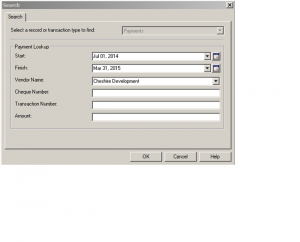

Now you are on Search screen. Fill in the selected fields with the information you have. The start and finish date should be within the time the original cheque was done. Choose the vendor name, if you have the previous cheque number you can fill in the Cheque Number field, if you have the Transaction Number or Amount you can also fill in those fields. Normally I just make sure my dates are correct and choose the vendor or supplier name and click ok.

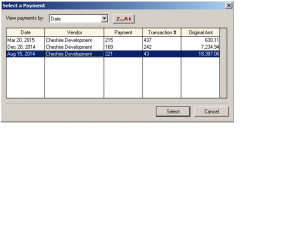

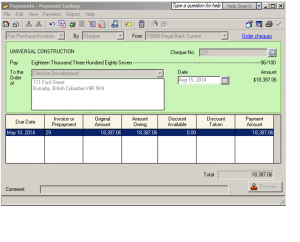

A Select a Payment screen pops up. I will choose payment (same as cheque number) 221 and hit Select.

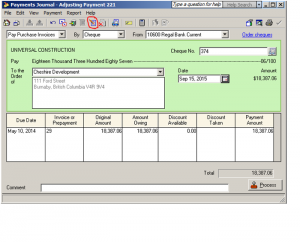

This is your original payment. In this view, none of the fields is available for change. You need to click on Payment drop down menu and choose adjust Payment or click on the short cut pointy red pen.

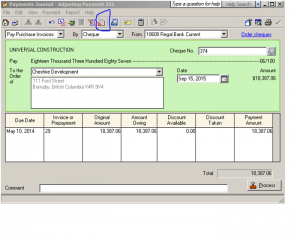

Now the fields are available for you to make changes. I changed the cheque number and date.

NOTE: You can also cancel/void this payment using payment drop down menu and choosing Void Payment or by clicking on the shortcut red X. This will reverse the payment and put the invoice back on supplier account as unpaid.

This concludes our tutorial session. If you have any comments or questions feel free to drop me a note.

Thanks for coming to my web site.

How do you stop payment on a payable check from a different period. Issued in Nov. and still o/s on the November bank rec., but in December you need to put a stop payment on the check and re-issue.

Hi Christine

You need to put a stop payment and reissue a chq.

In the purchase journal enter the amount as an invoice and for invoice number put StopPmt followed by original invoice#.

you need to do this twice. once as a debit to cancel the November payment and again as a credit to set it up and pay.

you need to date both these entries in the current date. do not back date and affect the November bank stmt.

for an expense account use the appropriate expense account it will not affect the financials as the entry will be a credit followed by debit. do not allocate any taxes.

nk

Thank you, loved it.

I need to stop payments on 2 cheques, one written Oct.27/17 and the other Nov.3/17 (they were lost in the mail). And I need to reissue payment for them. What is the best way to do this without affecting prior periods?

Could I go into our 2017 year cancel the cheques and reissue new cheque numbers using the original dates, then go into your 2018 year and make the same entries using the same dates?

Hi Carolyn

You need to stop payment and re-issue a cheque.

I did up a short tutorial for you and hope it will help.

Please follow the link below.

http://www.simply-accounting-tutorial.ca/simply-accounting-tutorial/how-to-re-issue-payment-cheques

hope it is helpful

nk

What if the scenario is that I issued a check in July and realized that the July accounting period was closed. I issued a new check dated, August 1, but I haven’t Voided the original.

Is it still possible to do this without affecting the July period?

Hi Marlene

You did up a chq in July that needs to be reversed.

The chq that is posted in July needs to be reversed otherwise your financials will not be correct.

I am not sure if this is a supplier chq or a payroll chq.

I did up a tutorial for voiding a supplier chq.

Hope this helped. Let me know if you have any other questions.

follow the link or copy and paste it into the URL.

http://www.simply-accounting-tutorial.ca/accounts-payable-tutorial/how-to-adjust-or-void-cheque-tutorial-on-sage-50

nk

I messed up a cheque How do I void it

Hi Shirley

You need to void a chq.

I did up a tutorial for you.

Follow the link or copy and paste it into the URL.

http://www.simply-accounting-tutorial.ca/accounts-payable-tutorial/how-to-adjust-or-void-cheque-tutorial-on-sage-50

nk

My next cheque to write was number 69. When I went to enter this on the invoice it says that it was a duplicate entry. apparently I had already used it. I had to skip over this and use the next blank cheque #70. I can’t find where cheque number 69 went. Any ideas?

I prepared a purchase invoice and then did the payment in Simply. Then I started to write up the paper cheque when I realized that there was no tax for the transaction, so I adjusted the amount of the cheque to the correct amount. I then went back to Simply to adjust the purchase invoice and it said something about the payment already being made (because I did the payment online before writing the cheque). Somehow I ended up doing a credit, but I don’t need the credit since I was able to adjust the paper cheque before it went out. How do I get rid of the credit?

Hi Cheryl

you need to get rid of the credit posted in purchase journal.

by doing that post a positive amount and use the same account number that the credit was posted to.

ex: if the credit was posted to Office Supplied than post the debit (positive amount) to Office Supplies.

The credit will offset the debit and it will be fine.

hope this helped.

nk

How do you void a cheque that was never cashed and the period is closed? It still shows up as an outstanding cheque every month?

Can I void it without opening up the period?

Hi Janeinne

you want to void a chq that the date is stale.

if you void the original entry from months ago, it will affect all your prior reconciliations.

to avoid that, in the purchase journal make an entry with current date or the date you needed to reflect and in the “amount” section of the purchase journal enter the amount as negative. ex: -100. and the taxes will be calculated accordingly and post properly to expense and GST accounts.

You can enter the old invoice number with a CR after it so it will be unique. Ex: 45989CR

the setting should be on cheque and not Pay Later so the bank will be debited once you process.

for the cheque number give it the old number ending with REV for Reverse. ex: 1265REV.

Hope this helped.

nk

How to void an NSF cheque from customer in Sage 50

Hi Sara

How to void an a customer NSF chq.

enter the NSF amount under the customer name as if your doing a sales invoice, except the account number will be the bank and allocate no GST.

EX: the amount is $100., enter the $100. under the customers name and the amount will be posted to the bank account and not GST allocated.

The invoice number can be the original invoice number followed by NSF so you know why this invoice number is being used again as well as it has to be a unique number each time.

Hope this helps.

nk