Simply Accounting © 2011 – Getting Started

Running SA 2011 Free Trail for the First Time

SA 2011 is designed to help even beginners to start their bookkeeping without prior CGA credentials. It serves as an Accounting Tutorial as well as an Accounting Program.

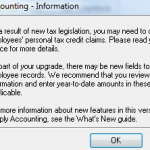

In the previous post called Accounting Software Free Trial we explained the download and installation process. In this article we are going to run the newly installed version of © Simply Accounting 2011 under Windows Vista. (Each image listed in this article can be viewed in a larger format by clicking on it.)

Double click on the icon of “Sage Simply Accounting Enterprise 2011 – Trial Version” on your Desktop. Click on Activate Now and enter the Company Name and Key Code (I know it is 23 letters and numbers, the good news is that copy and paste does work here).

- Go with session date of Mar 31, 2015. This is the Sample Company data we are opening.

Getting Started dialog box helps you to get familiarize with the software. Snap shot of it looks like:

- And actual program interface starts in Enhanced view:

- At the left column there are Customers & Sales, Vendors & Purchases, and other useful categories a business deals with on a day to day basis. Clicking on each, will update the right pane with relevant information.

- Also note the last section at the bottom left called: Learning Centre. You can find out about New features and available training classes. Frequently Asked Question area addresses common issues and remedies.

What Does Simply Accounting 2011© Offer?

In summary they are:

- Saving Time: Payroll for Do It Yourself

- Choice of language: Bilingual

- Specific: Designed for Canadian Small Businesses

- Full featured: Inventory management, invoicing, cash flow, bill payments

- You are in Control: Report on your business health

- Multitasking: Several projects? No problem

- Flexibility: Plenty of options available

Thank you for staying with us so far and we will be updating our accounting blog tutorial site. Bookmark us for future reference. (We are working to make this website Smart Phone friendly for people on the go).

Today: December 16, 2010

Is it possible to unlink all linked accounts in the general ledger of Simply Accounting Pro software.

Also what are the errors below in regards to

1. Unhandled exception has occurred in a component in your application

2. Cannot access a dispersed objuect. Object Name Select DRCR Balance Form

Hi lIZ

Yes it is possible to unlink accounts in teh general ledger.

You can do that by clikcing on setup – settings and on the left side choose the modual you want to unlink.

The errors you are experiencing has to do with Simply Accounting’s own data base.

A tech at Simply Accounting has to give you a hand with that.

Good luck

I am disappointed in the non profit section of the 2011 pro. I have been using it and find it very confusing. The program uses business terms like customers, sales, invoices, pre-authorized debits etc. These have nothing to do with churches which have tithes, expences and maybe the odd cd or book sale. It is not specific enough. I can’t even figure out how to enter the last year’s balance into bank records so that I can begin to add deposits and record expense payments. I am not an accountant or bookkeeper, I am just an honest person who got the job and I am very frustrated. I shouldn’t have to pay $$89 + to get those very basic answers.

Jane Lewis

secretary/treasurer

Hi Kingdom Life Ministries.

You can change the terminology by going to your simply accounting home page and click on Set up and than Settings.

On the left side of the screen click on Receibable or customers whichever the Pro version has available.

Than, click on names.

Under the “Terminology” section you can change the names to match as close as possible to your industry.

You can do that for Payables and other modules.

If you are trying to enter the bank balance so you can start posting deposits and check, you can do that with a journal entry.

First find out what the balance is as of a certain date, for example if you are starting on Jan 1, 2012 than find out the bank balance as of December 31, 2011.

Make sure you have considered all the outstanding deposits and checks in your balance.

Once you know what the bank balance should be – click on general ledger or Misc Journal entry (depending on what Pro has) on the home page, Debit the bank with the correct amount and credit retained earnings account.

Hope this helps. Let me know if you have any other issues. Dont get frostrated, ask me.

I have a payroll cheque from last year that has not gone through the bank.(It is in last years statement) It is over 6 months old and the bank will not accept it. How do I cancel that cheque and issue another. I have the T4 issued and I cannot figure out how to cancel the cheque and issue a new one

Thanks

Claude Roberts

Hi Claude

Put a stop payment on the chq at the bank but dont cancal the chq on simply accounting because you have already issued the T4s.

Issue a new chq but dont post it. do the exact same hours and deductions and net out to the same balance, print the new chq but dont post it.

Once the new chq clears the bank, you can clear your oustanding chq from 6 month ago.

nk

Customers pay for a membership, when I entered it was debited to the bank 1020 and credited to accounts receivable 1200. How do I get this to credit membership fees 4120??

Hi Bonnie

Your AR entry is debiting the bank instead of AR and Credit 4120 membership fees account.

If you did this entry through sales orders and quotes, than you need to call up the entry again by:

click on sales, orders & quotes module, at the top of the screen their is a icon of blue eyeglasses “Look up an invoice”

Search Box opens – put the customer name in the field and or invoice# click select.

Select Invoice box opens – look for the invoice in question and click on select.

At the top bar click on Sales and choose Adjust Invoice.

Now you have your original entry and can make corrections.

make sure the Transaction field is set to Invoice and payment method is set to Pay Later.

In the body of the invoice, the Account number must reflect the sales account 4120.

To check entry prior to posting – drop down Reports and choose Display Sales Journal Entry.

Review how it will be posted and post the entry.

hope this helped. thanks for stopping by.

nk

Hi Bonnie

Customer pays and the invoice directly gets posted debit to bank instead of debit AR on the balance sheet and credit 4120 membership fees.

The only thing I can think of is if the payment method is set to cash or chq. and make sure the sales account is correct.

If this is not a regular customer and you have not set up an account for them, meaning you use One Time Customer.

Under this selection you can not do an accrual sales invoice. It gets deposited directly to the bank.

Set up all your customers and give them there own account. stay away from using the One Time Customer that Sage 50 provides itself.

nk

How do I format preprinted cheques on Pro 2011? It keeps saying I cannot change the template.

Hi Ted

Your trying to format a preprinted cheque.

I did up a tutorial and hope it will help you.

Click on the link below or copy and paste it into URL.

http://www.simply-accounting-tutorial.ca/simply-accounting-tutorial/cheque-format-under-reports-forms

nk