Small Business Payroll Software

Simply Accounting program is a full accounting package with payroll module suitable for even small companies as a payroll software tool. The payroll module allows for the creation of a cheque at anytime, eliminating the need to ever write a cheque manually. Payroll module is ideal for creating and calculating for the following payroll scenarios.

- Chart of accounts and linking of the accounts

- Employee setup

- Regular wages, overtime and double time

- Salary, management and commission wages

- Advances given and deducted from employees pay cheque

- Medical and dental benefits

- Company vehicle benefit

- Union dues

- Vacation accrued

- Vacation paid on every pay cheque

- Vacation paid out at holiday time

- WCB accrual

- Calculating CPP, EI and income tax (both federal and provincial)

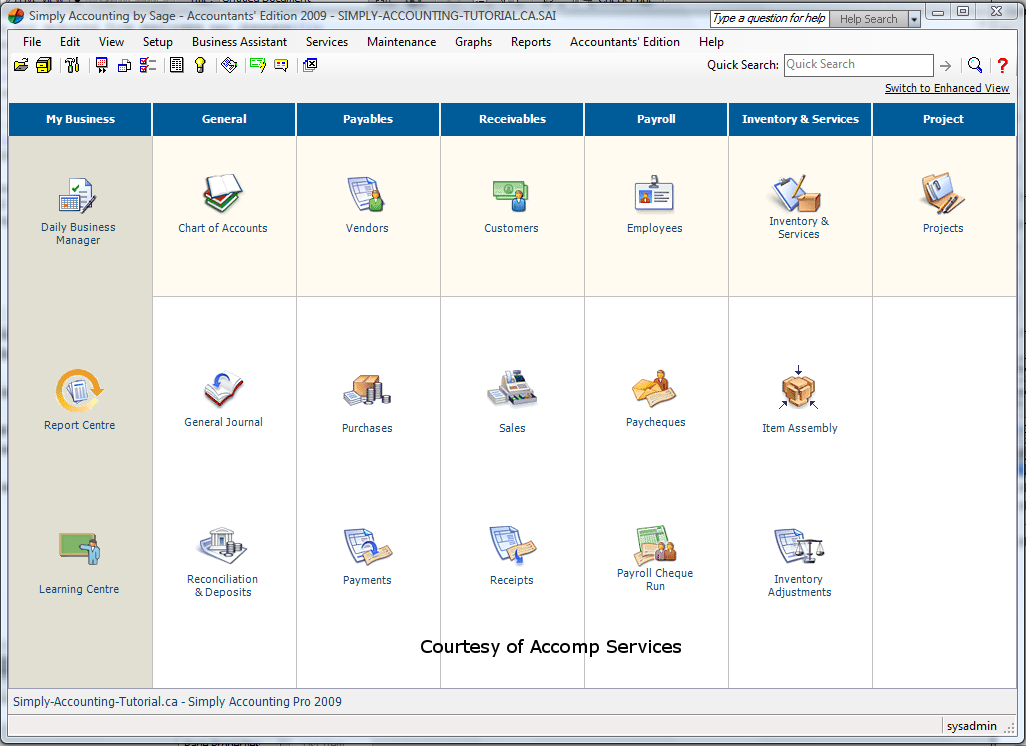

Lets take one step back and let me tell you that Simply Accounting has 2 style of home screen, classic and enhanced view. This tutorial is using the classic view.

On the top right hand corner of the home screen, you can toggle between home and enhanced view.

Classic View looks like this:

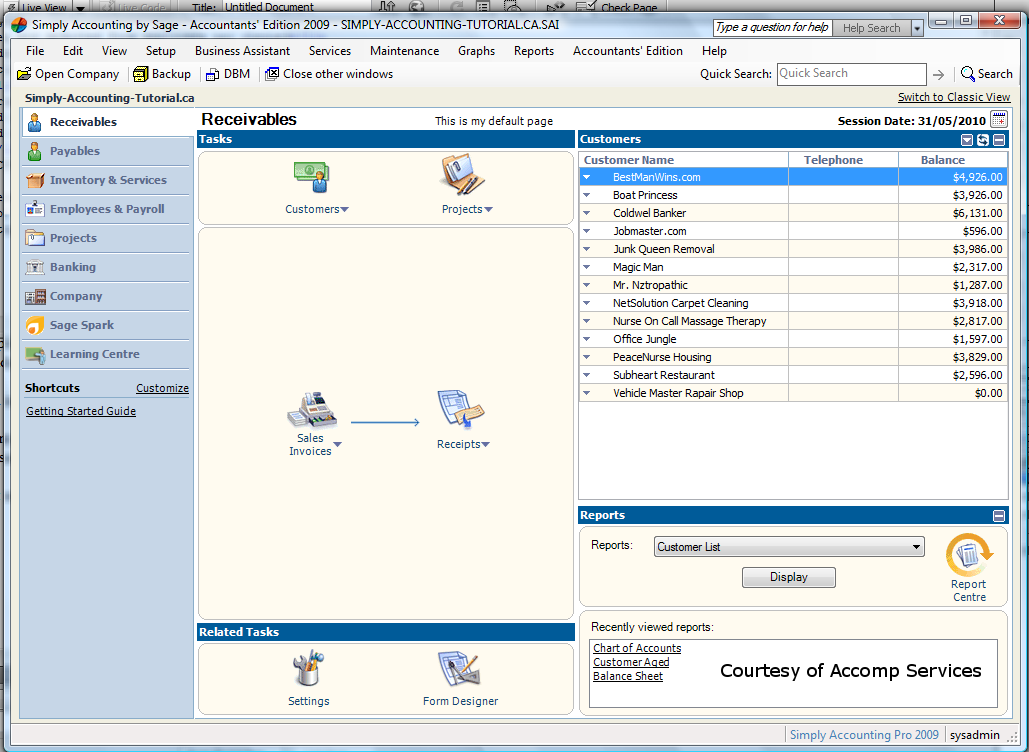

Enhanced View looks like this:

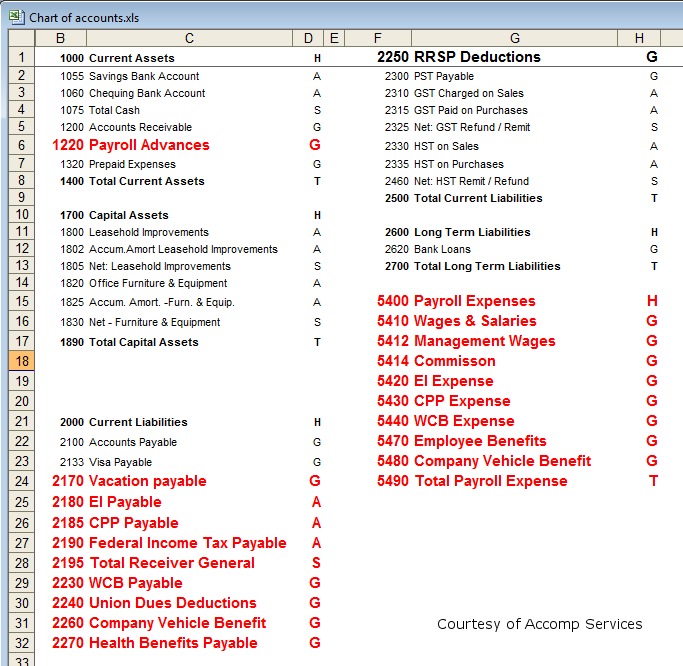

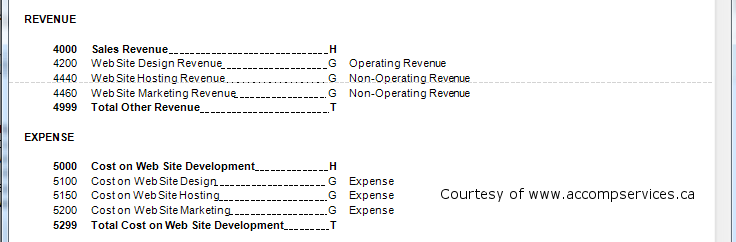

First Step to setting up payroll

Now that we have selected our view screen, there are some essential accounts needed to process payroll properly. Once these accounts are created, your payroll will run smoothly. Take a look at the chart of accounts and notice the 1, 2, and 5 thousand account number series. My screen below will look different than yours. I exported the chart of accounts into excel so I can highlight the important account numbers for you. The highlighted numbers are the ones you need to adopt and add to your chart of accounts. If your employees are in Ontario or Quebec you need to add:

EHI Payable, Employer Health Tax

Tax (Que) Payable, Quebec income tax.

QPP Payable, Quebec Pension Plan

QHIP Payable, Quebec Health Insurance Plan

and subsequent expense account in the 5 thousand account number series.

Chart of Accounts

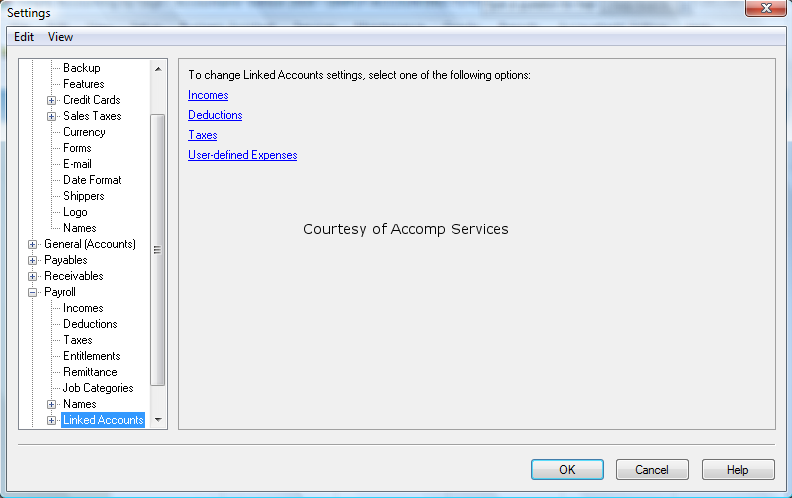

Linking of the Accounts

Before you can make the payroll module ready for transaction entries, you must set up the module’s linked accounts.You can set up the following linked accounts for the payroll module.

Business Bank account: Records the payroll cheques you issue to employees and deducts from your business bank account.

Advances Receivable: Records the total amount your employees owe you for advances you have paid them.

Vacation Payable: Records the total amount of vacation pay you owe your employees, if you do not pay out vacation pay on each paycheque.

EI Payable: Records the total amount of employment insurance you owe the government. The program calculates and totals the EI collected from employees and those payable to the employer. eg: if you deduct $10. of EI from your employees paycheque, the employer’s portion is 1.4% added and remitted to Receiver General of Canada. ($10. x 1.4%=10.14) The total owed to Receiver General of Canada is $20.14 ($10. + 10.14 = 20.14)

CPP Payable: Records total amount of Canada Pension Plan contribution you owe to government. The program calculates the totals of CPP contributions collected from employees and those payable by the employer. eg: if you deduct $15. CPP from your employees paycheque, the employer will match the same amount and will remit $30. to Receiver General of Canada. ($15.+$15.=$30)

Tax Payable: Records the total amount of federal and provincial income tax deducted from employee’s incomes. If your employees work in Quebec, this amount contains only the federal tax payable.

WCB Payable: Records the total amount of Workers’ Compensation Board contributions the employer owes the government. Other provinces may have a different government body for employee accident insurance plan.

Gross Wages, Salary and Commission employees: are recorded in these accounts. Gross wages refers to wages before any deductions are taken off.

EI Expense: Records the employer’s portion of the EI payables account. Look at the above example for EI. The $10.14 employer portion of EI will be recorded in this account as an expense to the business.

CPP Expense: Records the employer’s portion of the CPP payable account. Look at the above example for CPP. The $15. employer portion of CPP will be recorded in this account as an expense to the business.

WCB Expense: Records the expense associated with the WCB Payable account. This amount is a percentage of gross wages.

Let’s do some linking of the accounts.

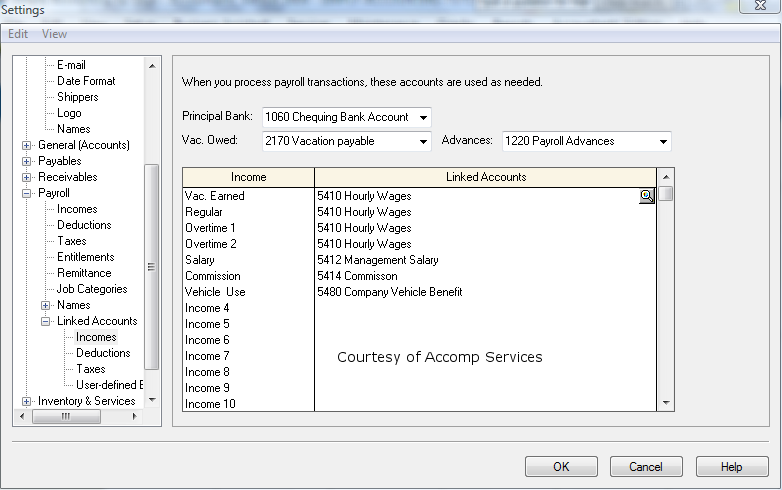

In the home screen of your Simply Accounting software, click on setup – settings – payroll – linked accounts. You have the following choices:

Income

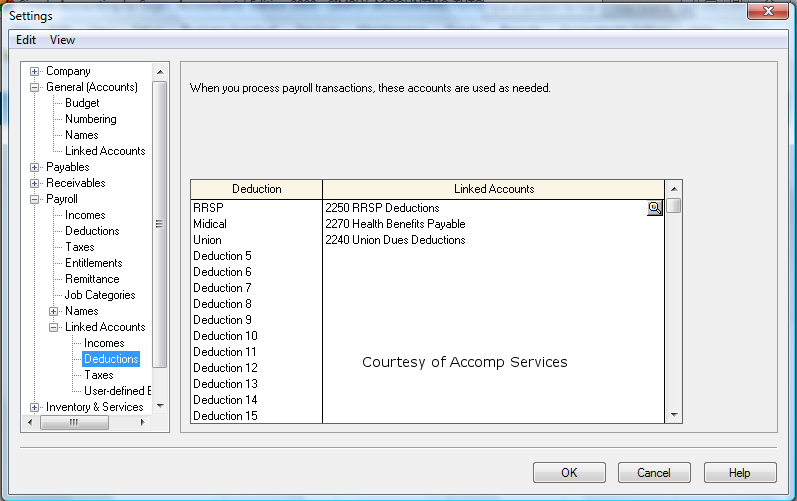

Deductions

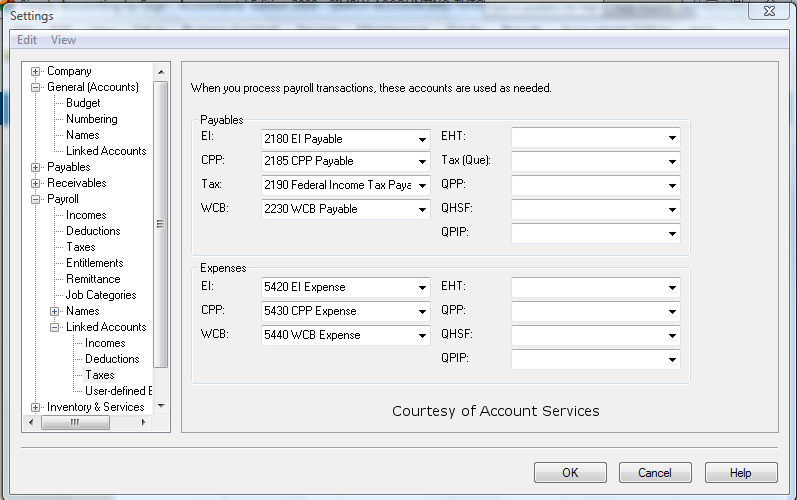

Taxes

User-defined Expenses

First – Choose income – Your screen should look like this. Fill in all the accounts necessary to link your payroll as I have done below.

Second – Choose deduction screen – Your screen should look like this. Fill in all the accounts necessary to link your payroll as shown below.

Third – Choose tax screen – Your screen should look like this. Fill in all the accounts necessary to link your payroll as I have done below.

This is where you would fill out the liability and expense accounts related to province of Ontario and Quebec.

You have now set up the essential link accounts to be able to run your payroll properly. Now let’s set up employee information.

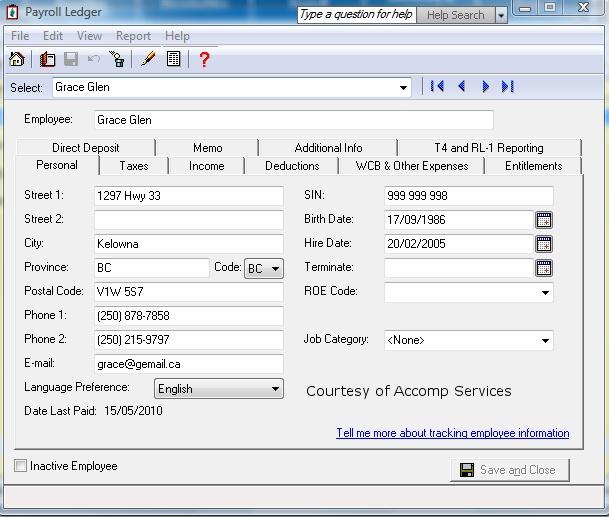

First – In your home screen on Simply Accounting software, click on employees, than file – create. Your at the personal tab, ready to enter employee information. Mine is already done so you can see where to put the information. It is important to have the birth date so the proper CPP can be deducted. CPP is deducted from employees over the age of 18.

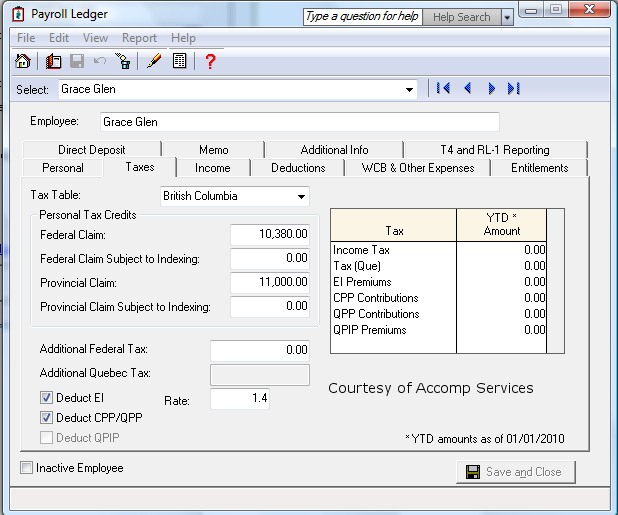

Second – Click on taxes tab. Here you will indicate the province the employee resides in and the federal and provincial claim amounts for that province. Notice the 1.4 % EI deduction in checked off as well as weather or not to deduct CPP/QPP from this employee.

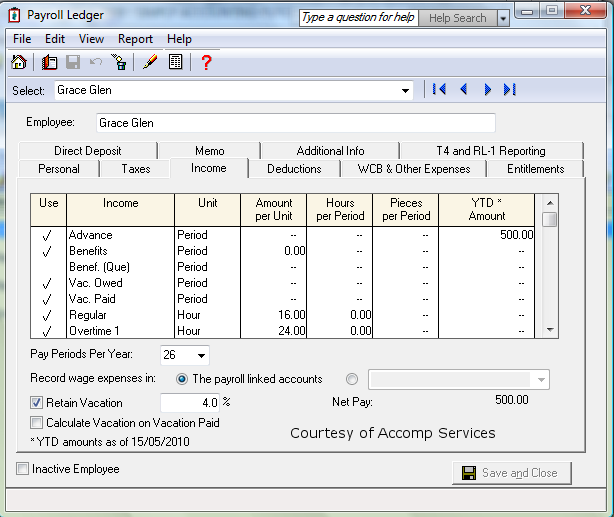

Third – Click on Income tab – In this screen you can set up the employee to be a salary, commission or hourly rate. You can also check off to retain vacation or to pay out vacation on every paycheque.

Indicate what you payroll schedual is, bi-weekly, semi-monthly or monthly. Some companies have weekly payroll.

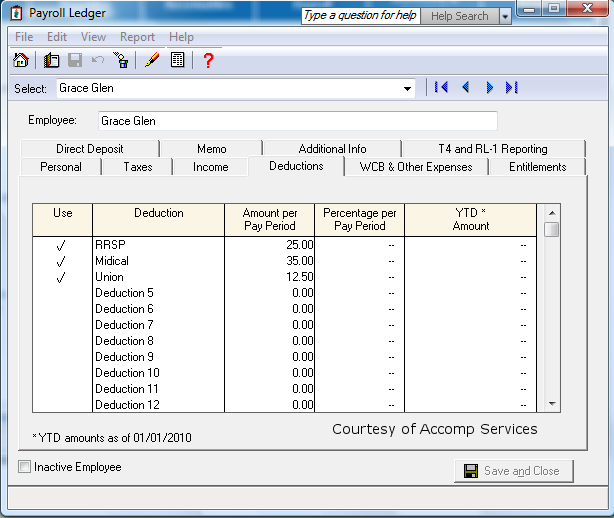

Fourth – Click on deduction tab – This is where you would enter any deductions needed to come off the employees paycheques. This will happen automatically every time you process payroll. If the deduction should be stopped, you need to come to this screen and take the amount down to zero.

Fifth – Click on WCB tab – Enter your WCB rate and the program will calculate the WCB payable on each paycheque.

You can also use additional information and the memo tab to record specific things related to your employees. Direct deposit is also available. Talk to your banker and get set up with them.

Create a Paycheque

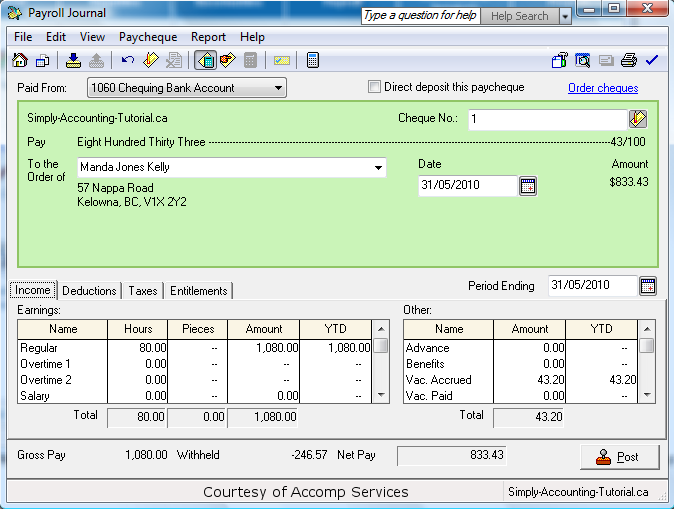

So, now let’s create a paycheque. go to your home screen and click on paycheques. You screen will be blank and ready for you to choose an employee. I have chosen Manda Jones Kelly.

From the top, your bank account is chosen but it can be changed, just drop down the menu and choose another bank if needed. The next available cheque number is recorded, the date of the cheque and the pay period ending date is recorded. This employee is an hourly employee and the vacation is being accrued to be paid when the employee goes on vacation. The gross payroll is $1080.00 less -$246.57 withheld and the net pay is $833.43.

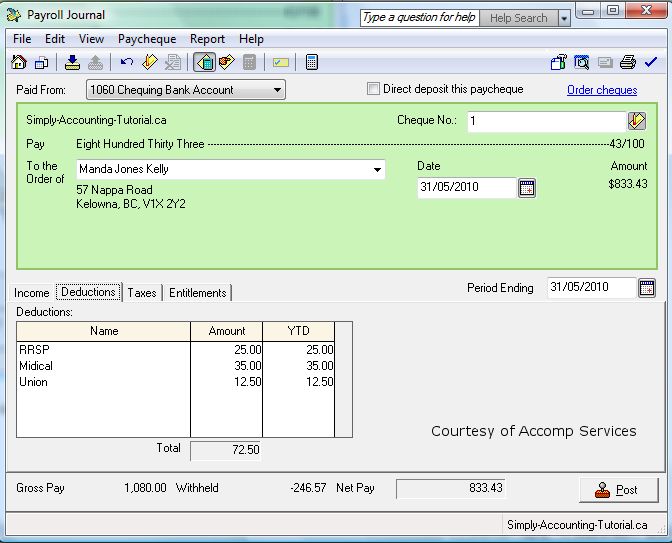

Click on deduction tab – Manda is being deducted RRSP, Medical and Union dues.

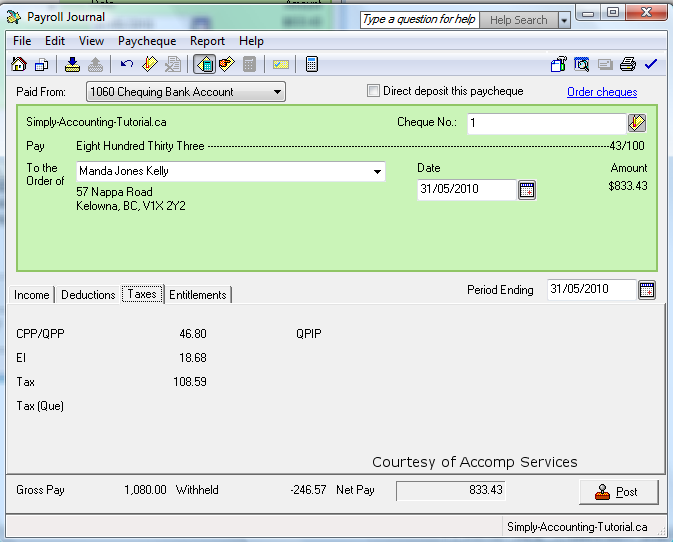

Click on taxes tab – Manda is being deducted CPP, EI and Tax from her wages.

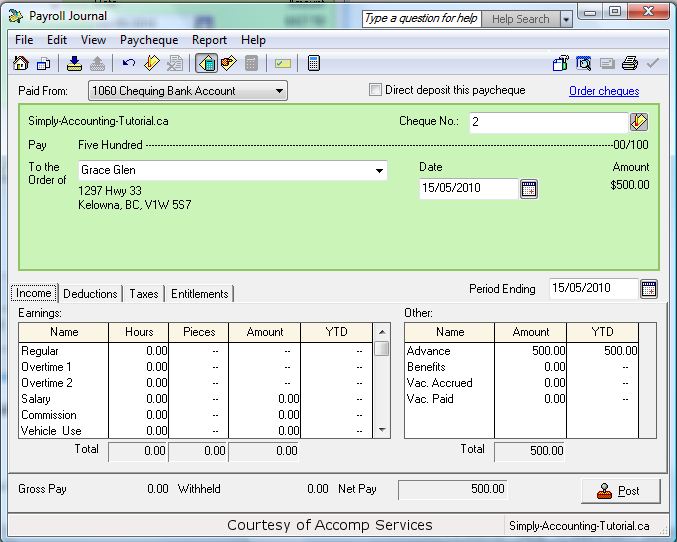

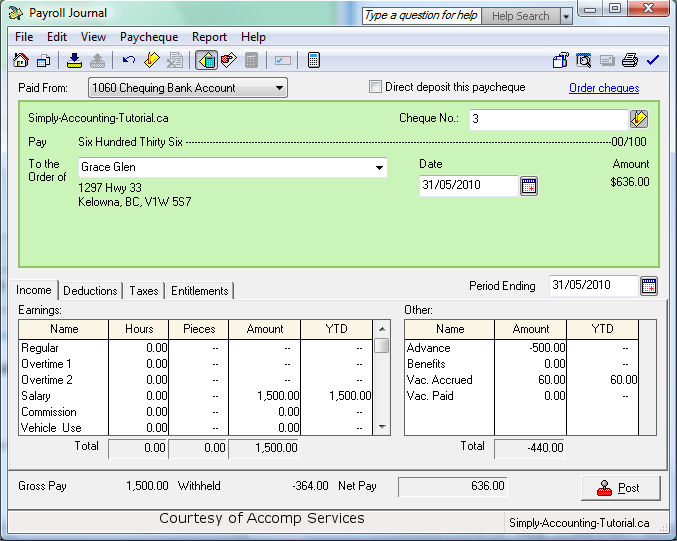

Let’s look at giving employee an advance. Grace gets paid $500. mid month and her full pay cheque at the end of the month.

Now let’s take back the advance and pay Grace her full paycheque. Notice the advance is a negative amount being deducted from her paycheque. The EI, CPP, and Taxes are being deducted as usual. And the deductions of RRSP, medical and union dues. Grace’s net pay is $636.00.

This concludes our session on Payroll Tutorial. I hope this has helped. Drop me a note below, if I can be of any help.

Good luck to all.

An interesting article from Globe & Mail of October 15, 2010:

Google added more than 1500 employees to its payroll in the third quarter. A record pace for the company – its operating expenses totalled 2.19 billion dollars, up from $1.6 billion a year earlier.

I looked at my balance sheet report and nothing is showing up in the account, receiver general payable. Do know why this would be?

One thing comes to my mind:

Click on Setup -> Settings. Go to Payrol and then to Linked accounts. Then click on Taxes. Make sure the payables section have the correct EI, CPP, Tax, WCB liability accounts.

Hi, thanks for the tutorial. The question I have is about the “Taxes” tab when creating a paycheque.

Being a small company of 3 employees, the service required to automatically calculate the CPP / EI amoutns is overkill. However, it would be nice to not have to key in the figures manually each time, as these are salaried employees whose amounts will be the same from period to period. Is there a way to store the CPP / EI / TAX amounts I want being deducted for each employee?

Thanks for any tips you can offer.

Within Paychecks module select the employee. Click on the icon at the top called “Enter Taxes Manually”. Then you can enter the Taxes manually. The figures to enter can be found on Government website. It is at:

http://www.cra-arc.gc.ca/esrvc-srvce/tx/bsnss/pdoc-eng.html?=slnk

(hint search for TOD)

To have it automatically done: CRA changes the deductions once every 6 months. Simply Accounting needs to be updated to the current tax tables.

When I get through the tutorial, the paycheques have 0 amount.

There are 12 pay periods per year, wages are a fixed amount per month. The only deductions are Income Tax and CPP. There are two employess.

How do I enter Income tax deduction and CPP deduction? What historical aounts need to be entered other than gross pay, CPP and Income tax?

I am switching from MYOB and have imported existing accounts.

Thank you

Richard

Richard

Simply Accounting automatically calculates taxes and CPP. There are some points to consider.

1- Within Employee module: Double click on one of the employees. Click on Taxes tab. Make sure Tax Table is pointing to the right Province. Also you need to enter the federal provincial claim amounts. Deduct CPP/QPP should be selected.

2- Now you can Start Paychecks module. Select the employee, and select the appropriate Earnings for the employee. Also keep in mind that at the top of the Payroll Journal, you need to enable “Calculate taxes Automatically” icon. Click on post.

On T4, there is gross pay, CPP, EI and Income tax. So if importing data from MYOB into Simply contains these historical information, then it should be enough. Unless there are other deductions and benefits.

I have been using Simply for the last couple years, but never used the payroll module, I entered the transactions via the General Journal.

We have started a new fiscal year as of Sept 1st, and I am entering our employees (we only have 2)and I am running into trouble in the employee records screen. Under the “taxes” tab, is there any way to manually update the YTD numbers to reflect the taxes/CPP that have already been paid? Or will I need to continue using my excel spreadsheet to track this for the remainder of the year?

Any ideas?

(and great tutorial BTW!)

Alison

If the program is in History mode (indicated by a feather beside all the top row modules), then you can enter them within Employees module (Payroll Ledger -> Taxes tab).

If it is out of history mode, it seems that you have to stick with the Excel spreadsheet.

A client is moving from proprietary payroll software to Simply. On the previous software, information shown on an employee paystub was: Gross/CPP/EI/tax, and tax deducted was further split into: Federal/Provincial/additional.

A number of employees pay additional tax as they may have other jobs, and want to make sure they don’t underpay at year end.

I can’t determine how to set up a similar breakout so as to provide that information on their Simply paycheque stub. Any help and advice would be appreciated.

Thanks

David

Thanks

Hi David

Simply Accounting does not breakdown Fedral/Provencial tax. It lumps it together.

But you can tell it to deduct extra tax by going into employee records and under taxes tab there is a section for additional federal tax. Put the desired amount in there.

Let me know if that helped.

I need to make an adjustment to payroll since i overpaid an employee. Can I put in a negative amt for the gross…positives for the cpp,ei,tax…with a net that is negative.

Hi Linda

You overpaid your employee.

Yes, you can put a negative in amt for the gross and positive in for CPP,Ei,Tax with a net that is negative.

you have to click on “enter taxes manualy” to be able to enter your own deductions.

nj

Hi There,

I have an employee who is on salary with the company (paid weekly – so we have it set up as 52 pay periods per year); but he is also paid a commission every 2 months on top of the salary. When I leave the pay period as “52” while doing up the commission cheque, it seems to take extra taxes out of him, but there is not an option to adjust it to 6 periods a year. Should I be adjusting it manually everytime to a lower pay period amount or just leave it at the 52.

Thanks!

Kate

Hi Kate

for paying commission to employee who is also getting weekly wages, you can setup the employee again just to do the commission chqs.

So, one employee record will be for wages and another will be for commission.

this means that at T4 time you have to prepare a T4 and a T4A for him.

Hope this helps.

nj

Thank you for the information, it was very helpful! The only other thing I am curious about is – he gets his commission cheques every 2 months – so it would be 6 pay periods a year; simply only offers the following options (1,2,10,12,13,22,24,26,52)- is there a way to adjust it so I can have it at 6 pay periods a year for the commission?

Thanks

Hi Kate

your choices for pay periods are set in simply accounting.

You wont be able to change to 6 pay periods a year.

nk

Hi there,

We are setting up Simply Accounting Pro (2012) from scratch, a company that has always done everything manually (yikes!)…they are wondering if there is a way to have a comments field in the printed payslip? I haven’t found anywhere to add this on the User Defined Payroll Cheque form…short of using Crystal Reports is there a way to add something like this? I was hoping to keep it simple for the user. Thanks very much!

Pam

Hi Pameal

You are right, there is not a spot for comments on the payroll chq.

There is a space for purchases but I wish they would add a comment area for pay chqs.

Your best bet is using Crystal Reports.

Good luck,

NK

Hello,

I have an employee who is now 65 years of age. He is still currently working full time with us but is no longer collecting CPP. He has asked me to take an aditional $25.00 off of his income tax for every pay. Would that aditional amount be added in the “Additional Federal Tax” field under the “taxes” tab?

Thank you

Hi Sara

Yes your correct. Go to taxes tab in the employees and under additional federal tax, enter the $25.

nj

Hi , My question is ,how to print the cheques for all employess in one shot?Employees paycheques are already posted.

Hi Log

You want to print all employees cheques at once.

From home screen click on paychqs and at the top of screen choose paychqs, pay multipal employees.

Here you can enter everyones hours and print.

nk

Hi, my question might be somewhat complicated.

We are an Ontario based company with a Quebec company, so we have employees who work in QC. Our QC company is considered construction. In payroll for QC there are many CCQ deductions – and complicated as heck. We currently use excel to make all of the calculations (deductions)and then transfer the data manually for each employee for each check. I’m trying to figure out if Simply can do the calculations automatically somehow? Is this possible? In trying to figure it out, my first bump in the road is that for the deduction portion of the employee’s information there are two options: Amount Per Pay Period and Percentage Per Pay Period. Most of CCQ deductions are an $/HR calculation. Is it wishful thinking that Simply can do these calculations manually?

Hi Jessica

Simply accounting can do the CCQ deductions for you.

You have to purchase simply accounting program with the payroll option. Once you do that simply accounting will give you a payroll code that you

will use to unlock the payroll modual and once you do that you can set up all your employees and let the program calculate all the CPP, EI and taxes.

it will be much simpler and you will be much happier.

nk

Hi Jessica

Yes SA can handle all your payroll needs.

You have to purchase the payroll modula from SA.

There are some set up involved but after that SA can run payroll and do calculations for you.

nk

I am wondering why the journal entry showing the breakdown of debits and credits shows the ei amount as different than what was entered in the tax deduction section of the payroll entries to issue a pay cheque.

Hi Anne

The reason why the ei amount is different is because it gets times 1.4%.

so, whatever the deduction amount is off of the employees chq the employer has to contribute 1.4% and add the two together and remit to CRA.

Same with CPP – what ever the employees portion is that gets deducted from their paychq the employer matches dollar for dollar.

Hope this helps.

Nk

Hi Jessica

Simply accounting can do the CCQ deductions for you.

You have to purchase simply accounting program with the payroll option. Once you do that simply accounting will give you a payroll code that you

will use to unlock the payroll modual and once you do that you can set up all your employees and let the program calculate all the CPP, EI and taxes.

it will be much simpler and you will be much happier.

nk

It seems there is an error in your example for E.I. Payable

I quote “EI Payable: Records the total amount of employment insurance you owe the government. The program calculates and totals the EI collected from employees and those payable to the employer. eg: if you deduct $10. of EI from your employees paycheque, the employer’s portion is 1.4% added and remitted to Receiver General of Canada. ($10. x 1.4%=10.14) The total owed to Receiver General of Canada is $20.14 ($10. + 10.14 = 20.14)”

The correct amount of E.I. payments paid by an employer is 1.4 times the amount paid by the employee. So, it is 1.4 times, not 1.4%. Therefore $ 10.+ 14.00= 24.00 to remit to the Receiver General of Canada.

Hi Hilda

Yes, the EI is 1.4 times the amoutn deducted from employee and remited to CRA.

NK

Hello,

Can I pay vacation pay that was kept back to be paid later

to an employee who stopped working for us using Simply Accounting?

Also, if it works, how?

Thanks

Hi Tina

Yes you can pay vacation to an employee that is no longer employed with you.

If you have created a record of employment you have to amend it to show the vacation.

you have to put the employee as active in order to pay them vacation.

Open the paychq modual, bring up the employee and on the right hand side pay out the

vacation amount shown as accrual.

NK

Hi,

I have entered a new reimbursement income in the Payroll set-up and made sure to link the income to the appropriate GL account. I have checked off the new income in the employee record, but when I go to create a paycheck – the new income does not show up. What am I missing?

Thanks

Hi Michelle

You have a new reimbursement income in the payroll and its not coming up when you do the paychq.

Follow these three steps and hopefuly it will help.

1- go to setup-settings-payroll-names-income and deduction.

There is a income and name colum. Scrol down till you get to an available name to change. I picked income 7 and changed name to remburs.

2- click on linked accounts – income.

There is a linked account and income colum. Scrol down till you get to remburs and asign it a account number from your chart of account. this number should be in the 5— series expenses. click ok.

3- in the home screen click on employees. choose the employee that you want to assign the remburs income to and put a check mark in the USE colum to activate the income.

Now – keep in mind that reimbursements to employees are not subject to deductions so, when your in setup-settings-payroll-income section make sure that the tax,cpp ei calc are checked off.

good luck.

nk

Hi,

I am starting a company using Simply Accounting. I don’t know how to link the payroll incomes accounts. The problem is that the company uses different wages accounts for different employees. How do I link Vacation Paid, Salary, Regular and Overtime if there are multiple accounts like Wages: Management and Wages: General? Plus one salaried employee is classified as management and the other is general.

Please help!

Thanks,

Olga

Hi Olga

You want to set up the linked accounts for wages and you have different wage categories.

You have to define the differ wage categories in the chart of accounts first.

so, go to your chart of accounts and in the 5 thousand series expense account creat all the wage accounts that you need.

ex: Account 5052 wage 1. 5054 wage 2, 5056 Salary, 5058 Management and so on.

Once your done go to the home screen and click on setup – settings – payroll – names – income & deductions.

under the income colum you have income 1 – 20 that can be utalized for your differ wage groups by changing the name.

Income 1 is currently used for Salary so leave that one.

Income 2 is used for commission – if you have commission employees you can leave this one too. otherwise you can recylce it and give it another name. you can over ride it by typing management.

Income 3 can be wages 1 and income 4 can be wages 2 and so on. These are the accounts you created in the chart of accounts.

Once your done clidk ok and your back to your home screen.

at the top click on setup – settings – payorll – liked accounts – income.

From the top enter the principal bank account number, the vac. owed account numer and if your company gives advances and loan to employees you can record the account number to track the advances and loans given out.

Now you have a colum for income and one for linked accounts.

You should be able to see the income 2,3 4 and so on that you re-named. click in the linked account section and choose the proper account number for the proper income category. Click ok when done.

Keep in mind when your creating your employees in the payroll ledger under the income tap put a check mark in the use colum so it will show up when your paying the employee.

Hope this helps. If you have any other questions please let me know.

nk

How do you pay WCB in simply is there some report to print that states the amount owing or do I just pay the amount based on total gross wages for the period?

Hi Terra

Your trying to pay your WCB. You can process WCB 2 ways.

1- at payroll level. Modify each of your employees records and on WCB tab put in the percentage that you have to pay WCB. Each time you process payroll it will take the amount and set it up as liability and record the expense at the same time Just like the ei,CPP an Tax.

You than can pull up a report for that account and pay the balance.

2- leave payroll modual out of it. If you make quarterly payments take gross wages and times it by the WCB percentage and cr bank and dr. WCB expenses.

Nk

I have an employee 68 years of age and has been collecting CPP for 8 years. With the new Rules for CPP he is required to pay into CPP unless he requests not to which he did not do for 2012 I now have to pay his and the companies CPP for 2012 and I want to recover his portion. Do I deduct the amount (weekly) as a regular deductions and what GL should it go to and how do I set that up.

Thank you

Hi Evy

You have an employer with CPP issues. You must have received a PIER report from CRA to pay. Your entry should be cr. bank and dr CPP expenses in the 5— series account. Only the employer portion. Set up a deduction in your payroll linked accounts, under setup-settings-payrill, and everytime you run payroll deduct an amount and post the credit to the CPP expense account until the debt is paid.

Nk

My cheques got out of number sequence, how do I make the system continue with the correct numbering sequence. I can change it each time but it goes back to the old(wrong) sequence every time.

I found the solution:

In home window, click “reports & forms”

Under cheque, select account you use

In cheque section,type in next chq # you want to start with, then OK

Why do I get this message, module cannot leave history mode because the ‘Wage Expense’ linked account is not defined.How can I change this?

Thanks

Hi Marilyn

You get this message due to some missing linked accounts.

Go to home screen and click on setup-settings on right hand side click on payroll-linked accounts. Put in the appropriate account for wages and all government liability account. By doing this everytime you process payroll these linked accounts are affected and will keep track of your payroll and remittance amount to CRA.

If you don’t have payroll disable the modual by clicking on setup-user preferences and view.

Uncheck the payroll module and ok.

Nk

can I use Simply Accounting (SA) for more than one small business company on the same computer ? In other words, if I am doing bookkeeping & payroll for 3 independent small home businesses, can I do this using the same SA program installed on only 1 computer ? and be able to keep these separate from each other ?

If this is possible, how do I do this ?

Thanks !

Hi Selina

Yes, you can use the same simply accounting SA program for multiple companies.

Nk

/deposits &Prepaid orders cannot leave history mode because linked account is not defined. Have no idea what this means. I’m trying to turn the year and it won’t let me.

Hi heather.

This s simple. Go to setup, settings, receivables, linked accounts.

In the Deposit and prepaid orders repeat the accounts receivable account.

Nk

I have posted payroll cheque for owner and it we to wages and the accountant says it should go to shareholder loan, how do I make the correction

Hi Sandra

Owners wages to shareholder loan.

the payroll entries need to be cancelled and a journal entry or you can set up the owners as a vendor and pay them through the purchase journal.

by cancelling the payroll entries you will have a debit balance in your source deductions. let the accountant know about the debit balance.

nk

I am having trouble changing the hourly rate of pay for an employee. Tried changing the rate in the employee screen and it won’t let me. Does anyone have a solution to this. It is like I am locked out.

Hi Esther

You want to change employee hourly rate.

Make sure you are in single user mode to make the change.

or – in Employee records the Use colum is checked off and Unit colum is Period and Amount per Unit is where the hourly rate will be.

or – go to home screen-setup-settings-payroll-linked accounts-income. make sure the income and linked account colums are correct. The account number is set to each income category.

Hope this help.

nk

when you add an amount in the additional federal tax section does that amount come off every paycheque?

Hi Gina

when you add an amount in additional federal tax section it does come off each paycheque.

It gets added to the calculated regular amount.

Ex: if the federal taxes normaly is apx. $500. bi weekly the additional amount of federal tax is added to the $500.

Hope this helped.

nk

Howdy! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations? debdakdfadeedaak

Hi Smith

The best way to keep your data secure is by baking up.

At my work place. I back up every day and I use the date as file name.

Back up on your hard drive as well as on a USB or other external drives and take it home.

If anything happens – Sage will allow you to download the software and the back up can be restored.

Thanks

nk